· 9,657 people surveyed; 68% are from rural India while 32% are from urban India

· Household spending increased for 56% (net score +48)

· Spends on essentials increased for 32% (net score +20)

· Spends on non-essential products increased for 5% (net score 0)

· Health-related expenses surged for 32% (net score -21)

· Consumption of media increased for 24% (net score +4)

· Mobility increased for 8% (net score +2)

· 31% believe India will not experience an economic recession

· 36% affected by job cuts & lay off to some extent

· 4% purchased summer durable products, 9% still planning to buy

· 21% increased consumption of ice creams and beverages.

· At an overall level, only 12% aware of AI-related tools

Axis My India, a leading consumer data intelligence company, released its latest findings of the India Consumer Sentiment Index (CSI), a monthly analysis of consumer perception on a wide range of issues. The June report reveals intriguing insights into the changing spending patterns and consumer behavior in India. Notably, overall household spending has remained consistent, with a slight increase in Rural as compared to Urban markets. Furthermore, the survey shed light on consumer preferences for summer durable products like air conditioners (AC) and refrigerators and summer products such as ice creams and beverages, revealing a slightly muted summer. These findings provide valuable insights into the evolving market trends and consumer preferences during the summer season.

The June net CSI score, calculated by percentage increase minus percentage decrease in sentiment, is at +9, which has remained the same as compared to last month.

The sentiment analysis delves into five relevant sub-indices – Overall household spending, spending on essential and non-essential items, spending on healthcare, media consumption habits, entertainment & tourism trends.

The survey was carried out via Computer-Aided Telephonic Interviews with a sample size of 9657 people across 33 states and UTs. 68% belonged to rural India, while 32% belonged to urban counterparts. In terms of regional spread, 30% belong to the Northern parts while 27% belong to the Eastern parts of India. Moreover, 30% and 13% belonged to Western and Southern parts of India respectively. 68% of the respondents were male, while 32% were female. In terms of the two majority sample groups, 30% reflect the age group 26YO to 35YO and 31% reflect the age group of 36YO to 50YO.

Commenting on the CSI report, Pradeep Gupta, Chairman & MD, Axis My India, said “Understanding the shifts in consumer spending patterns is crucial in adapting to the evolving market dynamics. Household spends at an overall level has remained consistent, signifying the stability of the Indian economy. Additionally, the slight rise in essential spends for rural consumers underscores the importance of meeting basic needs by the segment and the sustained demand for non-essential and discretionary products highlights the aspirational mindset of the 26-35 age group. The insights from our survey shed light on the cautious approach towards summer season categories, with a significant majority opting to delay their purchase. These shifts in consumer behavior reflect evolving aspirations, changing priorities, and the need for businesses to adapt and cater to their evolving needs."

Key findings

· Overall household spending has increased for 56% of the families, which is the same as last month. The net score, which was +48 last month remains the same this month. The increase is slightly higher in Urban households.

· Spends on essentials like personal care & household items has increased for 32% of the families, which is the same as last month. The net score, which was at +21 last month is at +20 this month. Essential spends has increased more for the rural segment of the consumers (34%) as compared to Urban (29%).

· Spends on non-essential & discretionary products like AC, Car, and Refrigerator have increased for 5% of families, which is the same as last month. The net score, which was at +1 last month, is 0 this month.

· Expenses towards health-related items such as vitamins, tests, healthy food has surged for 32% of the families. This reflects an increase in consumption by 1% from last month. The health score which has a negative connotation i.e., the lesser the spends on health items the better the sentiments, has a net score value -21 this month. Health related products consumption increased more for rural segment of the consumers (33%) and among those with a monthly income of 31000 and above (about 37%).

· Consumption of media (TV, Internet, Radio etc.) has increased for 24% of the families, depicting a significant increase by 3% from last month and highest in the last four months. The overall, net score which was at +2 last month is at +4 this month. Media viewership has increased more among males (25%) and among 18-25 YO which (35%) as compared to older age groups.

· Mobility has increased for 8% of the families, which is an increase by 1% from last month. The overall mobility net indicator score, which was at +1 last month, is at +2 this month. Mobility is highest amongst the age group of 18-25YO at 12% as compared to other age groups.

On topics of current national interest

· The survey also threw light on the purchase plans for summer durable products such as air conditioners (AC) and refrigerators during the current summer season. It revealed that only 4% of the respondents have made a purchase, while 9% have plans to buy. In contrast, a significant majority of 86% expressed no intention to buy these products.

· The survey further explored consumer affinity towards summer products like ice creams and beverages compared to the previous year. Among the respondents, 21% indicated consuming more of these products this summer as compared to last year. A large sum of these respondents are 18-25YO (33%). A majority of 51% reported consuming the same amount as last year, while 28% mentioned consuming lesser than the previous year.

· According to the Axis My India Consumer Sentiment Survey, which encompassed a total consumer base of 9,567 individuals, the findings reveal varying opinions regarding the likelihood of India experiencing an economic recession in 2023. Among the respondents, 22% believe that India will witness a significant recession, while 19% anticipate it to some extent. On the other hand, 31% of the respondents expressed confidence that India will not face a recession, rest being unsure.

· In response to the question regarding whether respondents have been affected by job cuts or layoffs, considering those who answered "Yes" to being involved in a private/corporate job, the survey findings revealed that 17% reported being affected to a great extent, while an additional 19% stated being affected to some extent. Conversely, the majority of respondents, comprising 64%, mentioned that they have not been affected by job cuts or layoffs. These results thus highlight that a substantial portion of respondents have remained unaffected by such circumstances.

· Furthermore when asked about the frequency of using AI-related tools while working or studying at college, the survey revealed only a negligible percentage of respondents reported daily (1%), occasional (1%), or rare (1%) usage. In contrast, a substantial majority of participants either do not use AI tools at all (9%) or are unaware of their existence (88%). These results indicate a limited adoption and awareness of AI-related tools among the surveyed population, highlighting the need for increased education and exposure in this domain. Digging deep the survey further found that 28% of those who do use AI tools (daily, occasionally, and rarely) believe that it improves the efficiency and productivity of workplaces or educational institutions.

· When considering the ways in which AI tools influence their work or studies, respondents who reported using AI tools daily, occasionally, or rarely provided the following insights: 6% found AI tools effective in answering queries compared to other sources, 22% appreciated their ability to reduce workload and save time, and 4% acknowledged AI tools' capability to perform simple tasks with minimal interference. However 2% expressed concerns about relying too heavily on AI, and 1% reported a perceived loss of critical thinking and decision-making skills. These responses highlight the varied impacts of AI tools, ranging from improved efficiency and time savings to concerns regarding overdependence and potential effects on cognitive abilities.

· When asked about their beliefs regarding the potential for AI tools to replace human jobs in the future, respondents (excluding those who answered "Not aware”) respondents revealed a range of perspectives. 26% belief that AI tools do have the potential to replace human jobs. While 25% believe otherwise, a majority of such respondents were male (20%). Interestingly, 50% of respondents, acknowledged that only repetitive or routine tasks, which are susceptible to automation, will likely be replaced by AI tools. A majority of such respondents were male (51%).

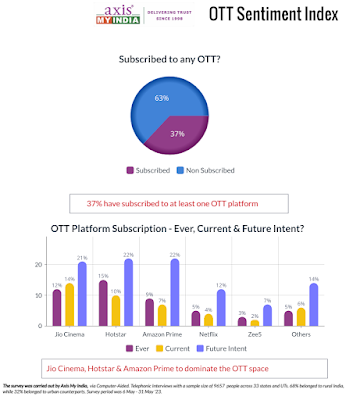

· When asked about the OTT platforms they surveyors have ever subscribed to, they provided a range of options. The top four OTT platforms mentioned include Hotstar (15%), Jio Cinema (12%), Amazon Prime (9%), and Netflix (5%). Other platforms mentioned by respondents include Zee5 (3%), Voot (1%), YouTube Premium (1%) and others (4%).

· Comparing the responses from the previous question regarding ‘OTT platforms ever subscribed’ to with the ‘currently subscribed platforms’, the survey observed some variations. Among the respondents, the top four currently subscribed OTT platforms are Jio Cinema (14%), Hotstar (10%), Amazon Prime (7%), and Netflix (4%). It is interesting to note that the order of preference has shifted slightly, with Jio Cinema now being the most widely used platform, followed by the others. Some platforms, such as, Zee5 (2%), YouTube Premium (1%), and Voot (1%), have also experienced slight changes in their current preference ranking. These findings highlight the dynamic nature of OTT platform usage and reflect the evolving preferences of the respondents in terms of their current subscriptions.

· Examining the responses to the question regarding future OTT platform subscriptions, some interesting patterns emerge. The top four platforms that respondents plan to continue using or subscribing to in the future are Amazon Prime (22%), Hotstar (22%), Jio Cinema (21%), and Netflix (12%). It is worth noting that while Amazon Prime and Hotstar maintain their positions, Jio Cinema has caught up with Netflix in terms of future subscription intent. Additionally, some platforms like Zee5 (6%), SonyLiv (2%), and others (13%) have garnered relatively higher interest for future subscriptions compared to their current or ever subscribed rates.

· Regarding upcoming India vs Australia World Test Championship in June 2023, the survey revealed varying levels of interest among the respondents. 24% expressed their intention to watch the championship on TV, while 19% preferred to watch it on digital/mobile platforms. Additionally, 9% indicated their plan to enjoy the championship both on TV and mobile. Among those who prefer TV, the majority are above 60 years (31%), while the majority of those who prefer digital/mobile belong to the age group of 18-25YO (37%)

· On rights of LGBTQ+ community, the survey delved into their opinions on granting equal marriage rights to same-sex couples. Among those aware, 57% firmly believed that the LGBTQ+ community should be afforded equal marriage rights as heterosexual couples. A majority of the responded who agreed to this view belonged to the age group of 18-25YO.

· When asked about their awareness of the same-sex marriage issue fought at the high court, the survey revealed that 25% are aware of the issue while a majority of 75% responded negatively, indicating a lack of awareness regarding the same. Among respondents who indicated awareness of the same-sex marriage issue fought at the high court, the survey sought their opinion on whether the Supreme Court's decision to leave the matter to the parliament is the right choice. Of those respondents, 57% agreed that it is the right choice, indicating their support for the Supreme Court's decision. In contrast, 34% disagreed with the decision, expressing their belief that the Supreme Court should have taken a definitive stance on the issue.

About Axis My India:

Axis My India is India’s foremost consumer data intelligence consultancy, which believes in fuelling data driven decision making. It has revolutionized the field of election polling in the country, with an accuracy rate of ~94% spread across 28 states and 8 union territories and 2 national elections. Axis My India’s research model is a Harvard Business School case study. The company has a presence in over 737 districts and has touched 190 million Indian households. It counts some of India’s largest corporations, state governments as well as Union Government in its clientele and offers a repertoire of research related services, including consumer insights, product validation, market segmentation, on-ground brand activation, personalized media solutions and micro marketing. The company publishes an annual Consumer Trust Index – spread across 45 consumer and product categories, and 1 million respondents.

For more information: https://www.axismyindia.org/

No comments:

Post a Comment