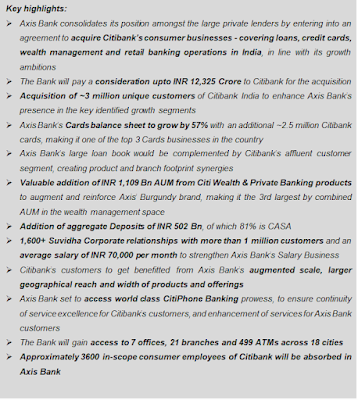

Axis Bank and Citibank today announced that their respective Boards of Directors have approved the acquisition of Citibank’s consumer businesses in India by Axis Bank. The acquisition is subject to customary closing conditions, including receipt of regulatory approvals.

The transaction comprises the sale of the consumer businesses of Citibank India, which includes credit cards, retail banking, wealth management and consumer loans. The deal also includes the sale of the consumer business of Citi’s non-banking financial company, Citicorp Finance (India) Limited, comprising the asset-backed financing business, which includes commercial vehicle and construction equipment loans, as well as the personal loans portfolio.

Axis Bank looks at this acquisition as a healthy strategic fit. It will gain access to the large and affluent customer franchise of Citibank having a bouquet of fee-oriented and profitable segments, that include quality credit card portfolio, affluent wealth management clientele, meaningful deposits with 81% being CASA, along with a strong consumer lending portfolio. Post the acquisition, Axis Bank will have ~ 28.5 mn Savings Accounts, 2.3 lakh+ Burgundy customers and 10.6 mn Cards.

The Bank has made large investments in people, processes and technology over the past few years. With all the required capabilities in place, it expects successful integration across all key parameters including employees, customers, product offerings and technology in a value accretive manner. Additionally, the deal offers strategic advantages to the Bank such as premiumization of its overall customer portfolio, increased opportunities to cross-sell its products and accelerated digital transformation.

The acquired portfolio would increase Axis Bank’s credit card customer base by ~31% with an additional 2.5 million cards, which will in turn bolster the Cards balance sheet position to be amongst the top 3 players in the Indian market. Moreover, the wealth and private banking portfolio will add great value to the Axis Burgundy business, further accelerating its growth ambitions in that segment. On an overall basis, the proposed transaction will add ~7% to the Bank’s deposit base (with ~12% increase in CASA) and ~4% increase in advances.

Axis Bank and Citibank together will ensure continuity of superior customer service levels, even post-closing of transaction, across all customer channels. Citibank’s customers will continue to avail all the rewards, privileges, and offers to which they were previously entitled. Further, Citibank’s customers will specifically benefit from Axis Bank’s wider geographical reach and comprehensive service offerings, along with One Axis capabilities that extend across all its subsidiaries. Digital Banking and the highly rated Axis Mobile app offering 250+ services will be an added advantage for customers, having immediate access to view and transact across product categories such as deposits, investments, payments and protection solutions. Moreover, the world class Citi Phone Banking will ensure service excellence for both Citibank and Axis Bank customers.

Speaking on the occasion, Amitabh Chaudhry, MD&CEO, Axis Bank said, “We are delighted with the addition of an enviable retail franchise and a high-quality talent pool as we continue our journey towards becoming a premier financial services brand, in line with our GPS strategy framework. This is a significant milestone in Axis’ journey of growth and leadership and will bring in great value for all stakeholders. The amplified scale and width of offerings, the diversified portfolio of products and global best practices will enhance customer experience, while greater synergies both on revenue and cost side will augment value for the new franchise.

We look forward to collaborating with Citi’s experienced senior leadership team and diverse talent pool, as they join Axis’ 86,000+ strong, dedicated workforce. Axis Bank already has a rich network of Citi alumni across the hierarchy, which reflects cultural alignment between the two organizations. Given the expertise that Citi employees bring to the table, we view them as a significant addition to our existing team that will help drive synergy realization and our GPS objectives. We welcome all employees to the Axis Family and together we will serve our customers ‘Dil Se’.”

Citi India CEO, Ashu Khullar said, “We are extremely pleased with this outcome for our consumer colleagues and clients. Axis Bank is committed to building its consumer banking business in India and is backed by a strong market presence. We believe Axis Bank will provide our employees an excellent environment to build their careers and shall meet all the financial needs of our consumer clients. We continue to remain committed to contributing to India’s growth and development as we deepen our presence through our institutional businesses and our community initiatives. Citi will also continue to harness India’s rich talent pool in the areas of Technology, Operations, Analytics, Finance and allied functional areas through its network of Citi Solution Centers that are located in five cities in India and support our global businesses.,”

A well outlined Integration Plan and a focused senior execution team will ensure smooth transition and seamless integration on all fronts, in collaboration with Citibank. The team comprising specialists with expertise in operationalizing large-scale integration programs will focus on Customer Service, Personnel, Systems & Technology, and other synergies.

Axis Capital and Credit Suisse acted as Financial Advisors to Axis Bank for the transaction, and Khaitan & Co acted as Legal Advisor. In addition, the Bank was supported by PricewaterhouseCoopers and Boston Consulting Group.

About Axis Bank:

Axis Bank is the third largest private sector bank in India. Axis Bank offers the entire spectrum of services to customer segments covering Large and Mid-Corporates, SME, Agriculture and Retail Businesses. With its 4,700 domestic branches (including extension counters) and 11,060 ATMs across the country as on 31st December 2021, the network of Axis Bank spreads across 2,665 centers, enabling the Bank to reach out to a large cross-section of customers with an array of products and services. The Axis Group includes Axis Mutual Fund, Axis Securities Ltd., Axis Finance, Axis Trustee, Axis Capital, A.TReDS Ltd., Freecharge and Axis Bank Foundation.

For further information on Axis Bank, refer to the website: https://www.axisbank.com

No comments:

Post a Comment